48+ how much should your mortgage be of your income

2000 is 33 of 6000 If you use a calculator youll need to multiply the. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term.

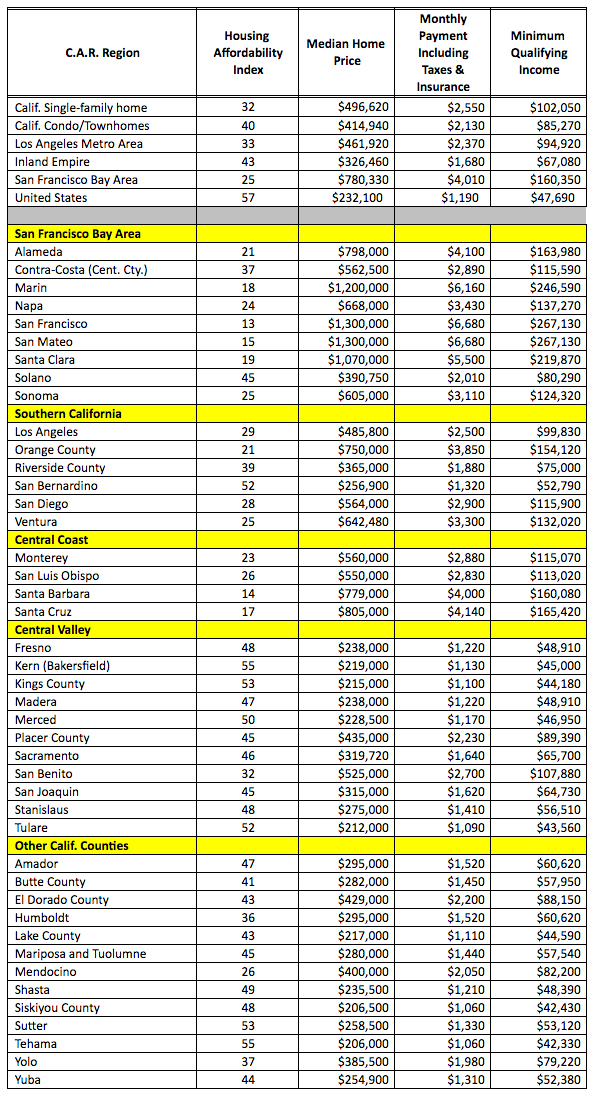

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

Get Your Quote Today.

. Web A 15-year term. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

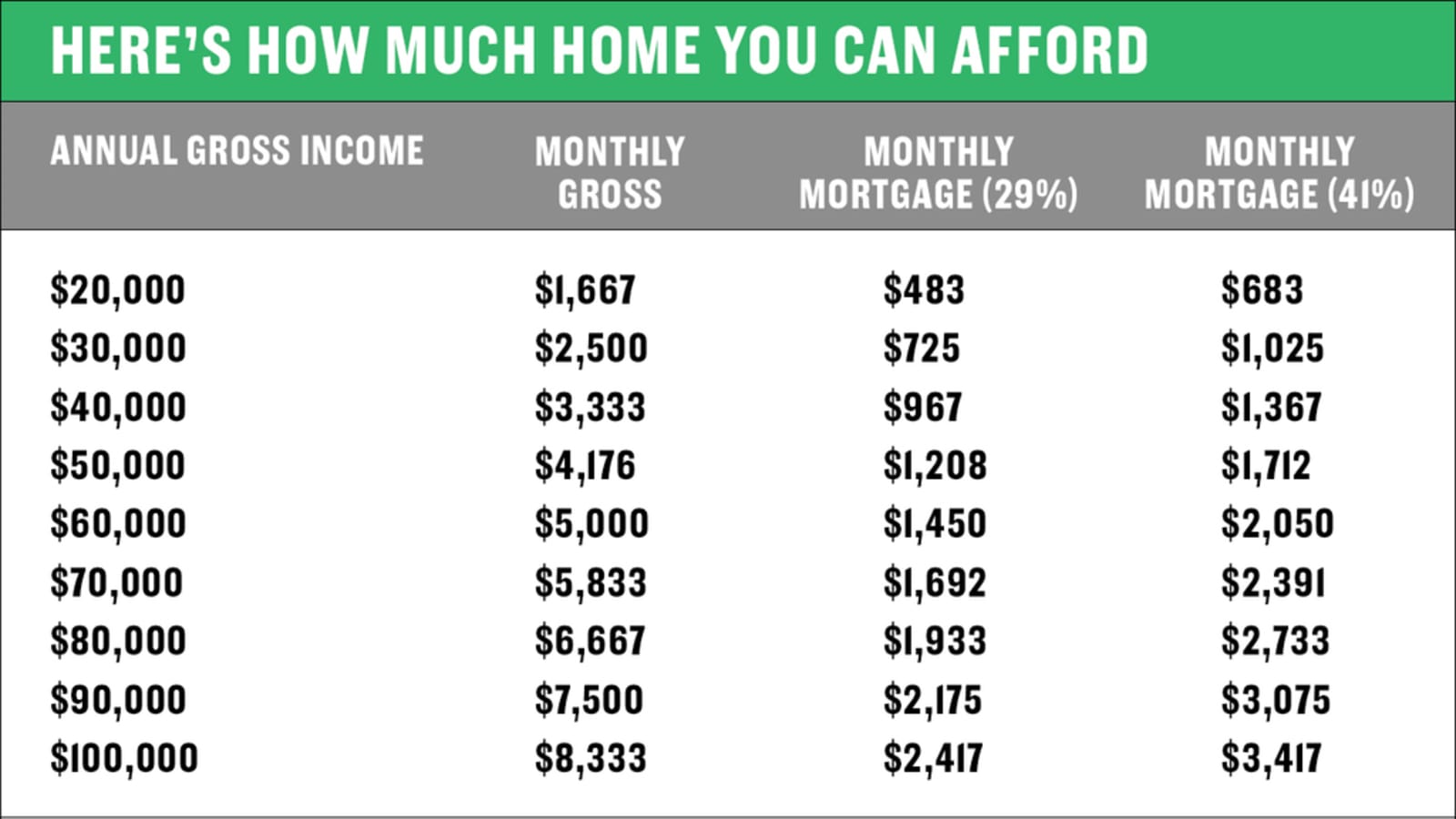

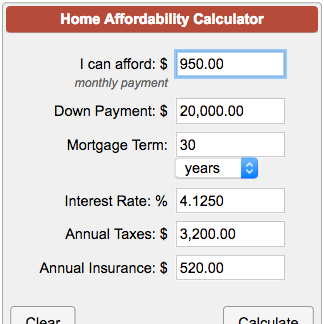

8000 35 2800. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Web To consider how much you can afford in a mortgage payment multiply your comfortable DTI by your gross monthly income.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Ad More Veterans Than Ever are Buying with 0 Down. Web How Much Income Is Needed For A 250k Mortgage.

You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. Web How Much Of My Income Should I Be Using To Pay Off Debt.

Compare More Than Just Rates. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent.

A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Web Combine that with your 1800 in monthly housing expenses and you get 2650 in total monthly debts. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Web The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of your gross monthly income aka. Principal interest taxes and insurance. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Web Many homeowners across the United States find themselves struggling to cover their housing payments and other bills. Ad Looking For Reverse Mortgage Calculator. Other rules say you should aim to.

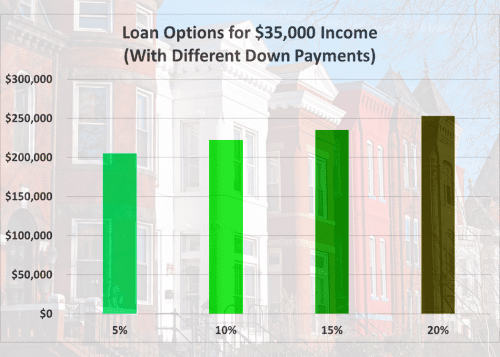

Get PreQualified for a Home Loan in 2023. A 250k mortgage with a 45 interest rate for 30 years and a 10k down-payment will require an annual income of 63868 to qualify for the loan. Web Following this logic in order to afford a 600000 home your income would need to be at least 350000 per year or higher.

Find A Lender That Offers Great Service. Ad See how much house you can afford. Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. However many lenders let borrowers exceed 30. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. VA Loan Expertise and Personal Service. Web Financial experts recommend spending no more than 28 of your gross monthly income on a mortgage and no more than 36 on total debt.

Web 25 Post-Tax Model. Web To calculate how much house can I afford one rule of thumb is the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home. Get 0 Down No PMI and More.

Based on your monthly income of 6000 your back-end. Save Time Money. This means that if you want to keep.

Web Keep your mortgage payment at 28 of your gross monthly income or lower Keep your total monthly debts including your mortgage payment at 36 of your. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Contact a Loan Specialist.

Estimate your monthly mortgage payment. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Take Advantage of Your Hard-Earned VA Mortgage Benefits.

Here S How To Figure Out How Much Home You Can Afford

The U S Is The Most Overworked Nation In The World

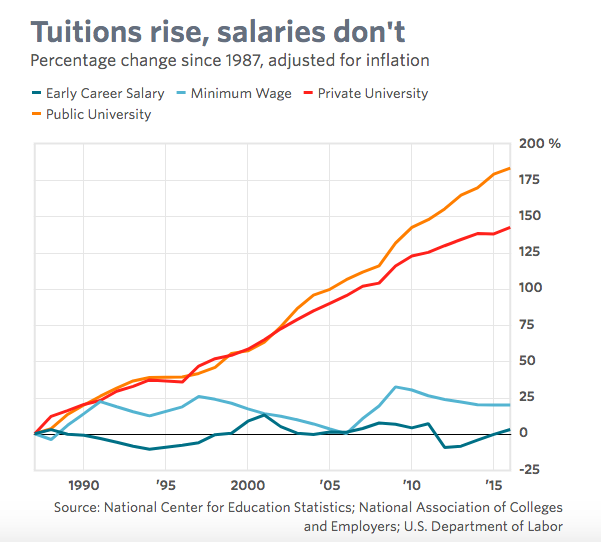

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

What Percent Of Income Should Go To My Mortgage

How Much House Can I Afford

What Percentage Of Income Should Go To Mortgage Morty

How Much House Can You Really Afford On 48 000 A Year

What Percentage Of Income Should Go To A Mortgage Bankrate

48 Sample Budget Worksheets In Pdf Ms Word

What Percentage Of Your Income Should Go To Mortgage Chase

How Much Of My Income Should Go Towards A Mortgage Payment

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Income Should Go To A Mortgage Bankrate

Mortgage Income Calculator Nerdwallet

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can You Afford Calculator Cnet Cnet

The Top 15 Life Hacks Of 2015